Archive for the ‘Economics’ Category

If you see just ONE graph this decade…

Dec 8, 2011 – Unsurprising, but jaw-dropping – this graph which George Monbiot linked to a few weeks ago. A continual rise in productivity, matched by a rise in wages… until around 1980. Hold in mind the perpetual rise in productivity, and consider…

Dec 8, 2011 – Unsurprising, but jaw-dropping – this graph which George Monbiot linked to a few weeks ago. A continual rise in productivity, matched by a rise in wages… until around 1980. Hold in mind the perpetual rise in productivity, and consider…

Polly Toynbee recently tweeted about Robert Skidelsky’s Occupy LSX talk: “Modern capitalism over produces work and under produces leisure…Skidelsky speaking sense… says 25 hr [working] w[ee]k… Citizens income for work/leisure choice.”

In his new book (on Keynes & the economic crisis), Skidelsky quotes a paper by Thomas Palley, which argues that under the neoliberal model (starting around 1980): “the commitment to full employment was abandoned as inflationary, with the result that the link between productivity growth and wages was severed.” With productivity growing and wages falling in real terms, consumer demand was built upon increasingly high levels of household debt.

All true, of course. But what many accounts leave out is the staggering level of technological advance since 1980. (Advances which ultimately wouldn’t exist without public funding/infrastructure). This enormous technological component of productivity doesn’t translate into wages for human labour, hence the necessity of solutions such as a Citizen’s Income.

It’s good to see commentators such as Robert Skidelsky and Polly Toynbee talking about a Citizen’s Income. This is the same proposal that goes under the names Basic Income, UBI, National Dividend, etc (I’ve written about these proposals in more detail here). I suspect you’ll be hearing a lot more about Citizen’s Income in the months/years to come.

Meanwhile, I think the graph should be tattooed onto our brains…

Sources of graphs:

http://www.nytimes.com/imagepages/2011/09/04/opinion/04reich-graphic.html

http://www.irle.berkeley.edu/events/spring08/feller/

http://thecurrentmoment.wordpress.com/2011/08/18/productivity-inequality-poverty/

http://jkornacki.com/?p=1195

http://www.huffingtonpost.com/jonathan-tasini/conspiracy-of-silence-wag_b_155531.html

http://currydemocrats.org/in_perspective/american_pie.html

http://www.rebelcapitalist.com/index.php/site/permalink/tapped-out/

http://the-wawg-blog.org/?tag=mega-rich

http://www.exponentialimprovement.com/cms/hannityinsanity.shtml

Framing Occupy’s “demands”

Nov 23, 2011 – Should the Occupy movement make specific policy demands? I see two different approaches getting coverage – eg George Lakoff’s (Huffington Post) and Michael Albert’s (Guardian)…

Nov 23, 2011 – Should the Occupy movement make specific policy demands? I see two different approaches getting coverage – eg George Lakoff’s (Huffington Post) and Michael Albert’s (Guardian)…

Lakoff says it’s “a good thing” that Occupy isn’t “making specific policy demands”. He argues that Occupy is about a shift in “moral focus”, and that, “If the movement is to frame itself, it should be on the basis of its moral focus, not a particular agenda or list of policy demands.”

Lakoff’s work (on moral-framing systems) shows how the American right succeeded by framing political issues in terms of a moral system which appeals to the “rugged individualist” identity, and which gives primacy to self-reliance and self-discipline, etc. Lakoff describes this moral system as follows:

“Conservatives have figured out their moral basis, and you see it on Wall Street. It includes: the primacy of self-interest. Individual responsibility, but not social responsibility. Hierarchical authority based on wealth or other forms of power. A moral hierarchy of who is “deserving,” defined by success.” [George lakoff, Framing Memo for OWS]

A large proportion of “the 99%” appear to vote out of identification with this “conservative” moral system – apparently against their own “rational” interests (as economists would put it). It seems important to realise this. Lakoff’s work is partly an attempt to explain why, and to offer alternative approaches (see below).

Michael Albert (co-editor of ZNet) suggests a different approach in his recent piece for the Guardian. Albert says that when a movement has sufficient strength (in numbers) it should make demands that “appeal to a very wide constituency”. The first example suggested by Albert is “the demand for full employment”:

“[S]eeking full employment makes sense because firing people is a way out of the current crisis that leaves elites stronger than they were before. It is a way out that leads right back to business as usual, with, in addition, a bonus for the rich and powerful in the form of a weakened working class. Clearly, we don’t want that. We want the opposite, a stronger working class and weaker elites. And that is the point. Full employment strengthens all workers, and it weakens all owners.”

[Michael Albert, Guardian, 15/11/11]

Albert adds that the larger “workforce” would work fewer hours “until the economy is back in shape”. He suggests “30 hours’ work for 40 hours’ pay, at least for everyone who is earning less than some quite high amount”.

“Full employment” – a fascist notion?

I shudder in horror whenever I hear the term “full employment”. The well-intentioned folk who propose it aren’t (I hope) thinking of forced labour, but it’s difficult to see how the latter doesn’t follow directly from the former. The ironies here… that a movement such as Occupy would propose an idea that seems deeply conservative* at best, and which has brutally authoritarian implications, at worst. Albert’s claim that “Full employment strengthens all workers, and it weakens all owners” seems, to me, an inversion of evidential reality in important respects – and it appears to confuse “employment” with livable income.

There’s enough material on the fascistic-seeming “full employment” framing for several articles, so I’ll leave further comment for future pieces. For now, consider the ways in which Michael Albert’s suggestions might conceptually “reinforce” the rightwing Economic Liberty Myth (a term coined by Lakoff). For example, Albert says Occupy should demand that people who have been fired are “rehired”. Central to the Economic Liberty Myth is the notion that employers “give jobs” to employees. This is what makes employers the heroes in the narrative – employers as the source not just of income, but of “meaningful activity” (“work”) and social relationships. The only other alternative (according to the myth) is: people sitting at home doing nothing, wasting their lives, isolated, socially useless parasites. In this quaint fairy tale, the employers – the bosses, the owners – save us all from that horrible fate. We demand it.

Lakoff’s alternative

To return to Lakoff’s idea: that Occupy frames itself “on the basis of its moral focus, not a particular agenda or list of policy demands.” What would this look like in practice? Lakoff’s analysis of the “nurturant” morality which underlies progressive politics suggests the following:

• Publicise The Public: Frame in terms of the common wealth, public infrastructure, public lands, public safety nets. As Lakoff puts it: “The Public is not opposed to The Private. The Public is what makes The Private possible. And it is what makes freedom possible. Wall Street exists only through public support. It has a moral obligation to direct itself to public needs.”

• Reframe The Private Market: Large corporations/banks act like private governments and should be framed as such. They use vast amounts of taxpayers’ money. And not just in bailouts. They’ve always depended on publicly-funded infrastructure. Avoid the corporation-as-individual metaphorical frame, which transfers the notion of “rights” from the domain of individual persons to institutions of concentrated wealth and power.

(My own modest contribution – explained here & here – is that the financial sector should be framed in terms of systemic risk rather than by conventional economic-framing of “competition”, “efficiency”, etc).

• Reframe Income/Work: Technology is, to a large extent, publicly-funded. (Boeing and Microsoft, for example, wouldn’t exist without the decades of public funding of aerospace and computer research and development). The great concentration of private wealth resulting from productivity increases (due to publicly-underwritten technological advances) should be framed as immoral. The so-called “labour market” can be framed as an ideological construct which has failed to provide a fair distribution of wealth, even with relatively high levels of “employment”.

Elsewhere (Moral Politics, p421), Lakoff has suggested a Negative Income Tax as a means of more fairly distributing wealth. But since we’re discussing how Occupy might frame a shift in moral focus, rather than specific policy, I won’t go into details here. (I’ve written about Negative Income Tax – and similar schemes – in a previous piece).

Additional material

Douglas Rushkoff does a great job of reframing the whole job/income issue here (video) & here.

See also this interesting piece on Lakoff/Occupy from the Overweening Generalist blog.

* I agree with Bob Black’s essay, The Abolition of Work, that all ideologies (whether Marxist, Liberal or Conservative, etc) seem conservative to the extent that they believe in maximising employment.

“Financial Crisis” & Media Compartmentalising

Nov 16, 2011 – Media compartmentalising, like frames, can be difficult to spot – particularly in reports which seem factually correct and relatively “balanced”.

Nov 16, 2011 – Media compartmentalising, like frames, can be difficult to spot – particularly in reports which seem factually correct and relatively “balanced”.

Take the global financial meltdown (or “credit crunch”, if you think it resembles a breakfast cereal). Much of the reporting of this complex set of events seems “correct” factually, and even in assigning blame. And yet… if you’re like me, you’ve found it inadequate and unsatisfying. There’s a massive cognitive disconnect here, and it can’t be explained in terms of simple media “bias” (political or otherwise).

Here’s the basic narrative from the best media coverage (in a nutshell and in my words):

The financial collapse stemmed from an ideology (Neoliberalism), in which the financial sector was given free rein to profit with minimum regulation – eg from the high-risk (and very lucrative) subprime lending market. Its false sense of security was due to inadequate models of risk which ultimately failed when the US property market crashed.

That seems accurate enough, based on the known facts. So why the cognitive disconnect? I would guess it’s due to media compartmentalisation of the following two areas:

- Framing of market ideology (“Neoliberalism”, “Capitalism”) in terms of things like “business efficiency” and “competition” in the real world.

- Framing of specific “failures” (particularly to do with “risk” & regulation) in the “virtual” world of finance.

The media reporting of the “facts” of the meltdown tends to use 2, with 1 as general background. The “failures”, as reported, occurred in 2, but the fundamental role of 1 in creating the conditions which led to those “failures” (and to the whole “crisis”) is rarely explored.

There’s a huge disconnect, for example, when regulatory “failures” are reported merely in terms of absence of attention to details and technical matters. The years of deregulation, and the failures of regulators, were both due to a culture in which “market discipline” was believed to be the most “efficient” form of regulation. (See my previous piece on the “market discipline” frame). This was an ideology, a sort of secular religion, in which the “free market” was seen as superior to all other forms of organisation.

Given the framed ideological primacy of competitive profit-making and the presumed non-reality of other kinds of social value, market self-regulation was taken for granted as the right way. One result of this (among others) was the rapid emergence of a multi-trillion-dollar market in over-the-counter derivatives – unregulated, not counted by any central authority… plus international agreements allowing banks to measure their own riskiness.

John Lanchester (author of Whoops! – one of the few accounts of the meltdown to successfully integrate 1 & 2 to produce a convincing narrative) gives an example of conventional media reporting, regarding the ideology:

“You get a glimpse into the world-view when you look at The Economist. It is […] full of good first-hand fact-finding. […] But every single piece, on every single subject, reaches the same conclusion. Whatever you’re reading about, it turns out that the solution is the same: more liberalization, more competition, more free markets. However nuanced and original the detail in the bulk of the piece, the answer is always the same; it makes The Economist seem full of algebraic formulas in which the answer is always x.”

Of course, if media reports were framed in a way that showed clearly how “x” was the main, central, primary, fundamental factor (or “cause”) creating the conditions that led to disaster, they couldn’t very well present “x” as the solution to every economic scenario. There are certain realities that The Economist (and other similar media) cannot ignore if they wish to remain remotely credible. And so we get compartmentalisation, whether intentional or not.

There has been, for a long time, a cultural divide in Britain between the The City (finance capitalism) and dirty industry/manufacturing. Ironically, the market ideology which led to massive expansion of the financial sector (over the three decades since Margaret Thatcher came to power) is built on a metaphorical framing (concerning things like “efficiency” and “free competition”) which goes back to Adam Smith’s era. When Smith wrote about the “division of labour” and the “invisible hand of the market“, etc, he wasn’t thinking about risk-modelling for Credit Default Swaps (CDS) on Collateralized Debt Obligations (CDO) on pools of subprime mortgages. He was thinking about “tangible” things like pin factories.

(The insurance giant AIG was the biggest player in the CDS market. It was brought to its knees by CDSs on CDOs, but was Too Big To Fail, and enjoyed the biggest bailout of a private firm in history. How’s that for “efficiency”, “competitiveness” and good old-fashioned industriousness).

Framing “risk” – and its importance

In my previous piece, and above, I’ve singled out “risk” as the all-important factor in the financial sector (in contrast with the importance placed on “efficiency” and “free competition” in general business). Why? Because risk determines the outcomes of finance-capitalism in a way that is far removed from our conceptions of things like competitive efficiency in the “real world”. This is illustrated by how banking works, even at a basic level…

Banks pay a low rate of interest to depositors, and charge a higher rate to borrowers – thus making a profit. Banks don’t really make money from providing a “service” – they make it from taking on risk (eg the risk of loans going bad). It’s a “respectable” form of gambling. There are, of course, rules governing the amount of capital (eg deposits) that banks must keep against the risk of loans not being repaid, etc. These rules limit the amount of lending (and other speculation) that banks can make – ie the level of risk they can take on. But they also limit the banks’ profits. The banks hate this. The ‘innovative’ financial products I’ve been writing about (the ones which played such an important role in the financial meltdown – CDSs, CDOs, etc) were designed to get around the rules on risk – in very complex, and profitable, ways – with the effect of making it practically impossible to monitor systemic risk.

Why Nassim Taleb seems angry…

If you haven’t already seen this entertaining clip of Nassim Taleb (author of The Black Swan) on Newsnight, I recommend it. Taleb is angry with “tie-wearing economists” peddling bogus measures of risk in the financial markets.

If you haven’t already seen this entertaining clip of Nassim Taleb (author of The Black Swan) on Newsnight, I recommend it. Taleb is angry with “tie-wearing economists” peddling bogus measures of risk in the financial markets.

If you pay attention to what Nassim is saying, you’ll see that he’s talking almost entirely about risk. (If you’re new to the topic, reading my previous piece might help to clarify some of his points). One of the highlights is when presenter Emily Maitlis asks, “Does this require a mindset change?”.

Alternative economic framing

Oct 11, 2011 – Newspapers mostly reflect “conventional” economics, whose textbooks describe variations on the “classical” market economic model, and little else. (Some of the more risqué texts might devote a page to Marxism, but that’s the only alternative we’re supposed to consider). Economics is framed as capitalism vs socialism. (Cognitively speaking, there’s a “good” reason for this limiting dichotomy – but I’ll save that for a future piece).

Oct 11, 2011 – Newspapers mostly reflect “conventional” economics, whose textbooks describe variations on the “classical” market economic model, and little else. (Some of the more risqué texts might devote a page to Marxism, but that’s the only alternative we’re supposed to consider). Economics is framed as capitalism vs socialism. (Cognitively speaking, there’s a “good” reason for this limiting dichotomy – but I’ll save that for a future piece).

John Lanchester, in his excellent economics primer, Whoops!, argues that the global financial collapse stems from the perceived victory of an ideology (“capitalism”): “That climate was one of unchallenged victory for the capitalist system, a clear ideological hegemony of a type which never existed before: it was the first moment when capitalism was unthreatened as the world’s dominant political-economic system.”

So, a dichotomy framed as a battle with a clear winner. The financial sector, given “free reign” (as well as “free rein”), became more powerful than ever. This is illustrated by Simon Johnson, a former IMF chief economist:

“From 1973 to 1985, the financial sector never earned more than 16 percent of domestic corporate profits. In 1986, that figure reached 19 percent. In the 1990s, it oscillated between 21 percent and 30 percent, higher than it had ever been in the postwar period. This decade, it reached 41 percent”. *

The financial sector rules – like “a class of priests and magicians”** – by instilling incomprehension and awe (even “experts” apparently can’t agree on many of the basics). In this milieu it’s safer for journalists to use conventional “accepted” economic frames – there’s less risk of exposing one’s ignorance. Alternative economic views/proposals thus receive little coverage.

The financial sector rules – like “a class of priests and magicians”** – by instilling incomprehension and awe (even “experts” apparently can’t agree on many of the basics). In this milieu it’s safer for journalists to use conventional “accepted” economic frames – there’s less risk of exposing one’s ignorance. Alternative economic views/proposals thus receive little coverage.

There’s an abundance of economic ideas which fall outside orthodox framing. The main difficulty is ploughing through them to find the ones which seem neither “crackpot” nor scary. Here are a few of my favourites…

Universal Basic Income (UBI)

A Basic Income is an income paid to all individuals, without work requirement or means test (which is what places it far outside conventional economic “wisdom”). People are free – but not obliged – to top it up with income from other sources, eg self-employment or jobs. Over the last two centuries this idea has been independently proposed under a variety of names – Citizen’s Income, Universal Benefit, State Bonus, Social Credit and National Dividend.

Several ways have been suggested to fund a Basic Income. Nobel prize-winning economist James Meade proposed a social dividend funded from the return on publicly owned productive assets. Some economists think that funding should come from redistributive income taxation or a tax on land. These ideas aren’t new – as far back as 1796, Thomas Paine favoured a state-provided universal income to compensate for the inequitable division of land, which he saw as belonging to everyone.

The Basic Income concept makes good bait to dangle in economic conversations. The uninitiated, taking the bait, will argue that it would remove the incentive to work, and nurture an “idle underclass”. In fact, compared to the existing welfare system, Basic Income provides a strong financial incentive for creative and productive activity (some recent research lends empirical support to this). With Basic Income it’s more financially rewarding to move from unemployment into a job – because you keep your Basic Income payments, whereas you would lose your dole. Many common types of work – eg low-paid casual, part-time or self-employed work – increase your disposable income under a Basic Income scheme, whereas the income from such work is subtracted from your dole under the current system. Many worthwhile activities – adult education, voluntary work, starting a business, etc – are penalised or even criminalised under the current welfare system, because they interfere with the condition of “continuous availability for work.” Most wealth-creating activity begins modestly, perhaps not generating enough for a person to survive on at first. Basic Income nurtures such activity, whereas the welfare system aborts it.

Guaranteed Income

Guaranteed Income is sometimes confused with Basic Income, but the important difference is that it uses a means test. Every individual is guaranteed a minimum income (set above the poverty level) – if your income falls below this level, you automatically get a top-up from the government, but as your personal income increases, the amount of top-up decreases. Guaranteed Income, like Basic Income, is not conditional upon work.

Several variations of Guaranteed Income have been proposed, the most well-known being Robert Theobald’s 1964 scheme for “Basic Economic Security”. Theobald was concerned about the effect of technology and increasing automation – he thought it was time to dissolve the traditional link between income and work, since most work would eventually be automated. By 1968, 1,200 economists (including John Kenneth Galbraith) called on Congress to introduce such a system. A Guaranteed Income in fact almost made it into legislation, under a proposal put forward by – wait for it – Richard Nixon. A book was written about it in 1973, by Daniel Patrick Moynihan (who was appointed to Nixon’s White House Staff as Counselor to the President for Urban Affairs). His book was titled: The Politics of a Guaranteed Income: The Nixon Administration and the Family Assistance Plan (1973).

Negative Income Tax

One variation on Guaranteed Income is the Negative Income Tax, which would provide government top-ups, via the tax system, to those below a certain income level. It should be pointed out to those who see this as a “soft” leftist idea, that Negative Income Tax was proposed by one Milton Friedman. In many ways, we’re outside the right/left framing dichotomy here. Friedman’s apparent intention was to create a system that costs less than the current welfare system (but which also avoids the degrading nature of welfare).

Willingness to Work?

Many so-called “guaranteed minimum income” schemes restrict entitlement, among the unemployed, to those “willing to work” – a condition similar to that of current welfare systems. The Belgian political theorist Philippe Van Parijs argues that when we assess willingness-to-work, we should make the distinction between pointless, dead-end jobs and useful, fulfilling or “stepping stone” jobs – and that the best people to make this distinction are the ones doing the jobs. This is in stark contrast to conventional economic framing, in which all market-created jobs are viewed as “good” and “worthwhile” – by definition.

Zero-interest Currency

A different type of non-coercive redistribution of wealth comes from the old Individualist (as opposed to Collectivist) Anarchist approach of allowing free trade to drive down the cost of “borrowing” money. This idea originated with early anarchists such as Pierre-Joseph Proudhon, Josiah Warren and Benjamin Tucker.

Free trade is supposed to drive down prices through open competition, but according to Proudhon, Warren and Tucker there is a fundamental flaw in the existing system: a lack of competition in the issuance of currency. The current legally enforced money-issuing monopoly (eg the Bank of England or the Federal Reserve) keeps interest at an artificially high level – if free competition were allowed in the creation and distribution of alternative currencies, the cost of credit could in theory fall to a rate well below 1% (the cost of administering the credit; true interest would be zero).

Ironically, this appears to be “true” free-market economics taken to its logical conclusions. The anarchists claimed that zero-interest currency would eventually remove all forms of usury, including “profit”, from economic transactions. Adam Smith’s principle of “labour being the true measure of price” would thus come into effect through free competition driving out all usurious components of price. Workers would be fully compensated for their work at last, and not a Marxist or Collectivist in sight.

Rusting bank notes – Stamp Scrip

“I believe that the future will learn more from the spirit of Gesell than from that of Marx”

— John Maynard Keynes

In 1891 an Argentinian businessman and economist named Silvio Gesell went one step further than the Individualist Anarchists by proposing a system of negative-interest currency. The most well-known form of this currency was “stamp scrip”, which required a stamp to be affixed to the back of a money note each month, to revalidate it.

Gesell believed that money is fine as a medium of exchange, but that it tends to be used as an instrument of power, capable of dominating and distorting the market. For example, money can be hoarded – temporarily withheld from the market for speculative purposes – without exposing its holder to losses. Real material goods, on the other hand, can’t be hoarded without significant costs – either in the natural deterioration of the goods, or in the cost of storage.

In order to encourage the natural circulation of wealth instead of speculative hoarding, Gesell proposed “rusting bank notes” (a metaphor for negative-interest money), to bring about an “organic reform” of the monetary system. With money behaving more like real material wealth, the distortions in the system caused by hoarding and other forms of usury would be removed. This, he argued, would result in people receiving the full proceeds of their own labour, and would enable large sections of the population to quit wage slavery and work in an autonomous manner in private and co-operative enterprises.

A successful experiment with Gesell’s theories took place in the Austrian town of Wörgl in 1932, during the depression. Wörgl effectively ran out of money, so the mayor of the town printed his own. The resulting currency, Wörgl stamp scrip, was designed to automatically earn negative interest. Each month its holders had to pay a stamp fee of 1% of the value of the note, so people spent the money as fast as possible. This resulted in a huge increase in “real wealth” – new houses, a new water system, repaved streets, a new bridge, a ski jump, etc. But when hundreds of other Austrian towns came up with plans to copy the successful Wörgl scheme, the central bank panicked because of the threat to its monopoly. It soon became illegal to issue alternative currency in Austria.

The Digital Economy

Apart from the possibility of alternative electronic currencies, the “digital economy” hasn’t delivered much of revolutionary economic impact (except in the sense of concentrating wealth more “efficiently”). The first electronic money-trading system was opened by Reuters in 1973, shortly after the dismantling of the gold standard and the Bretton Woods system (which regulated international currencies). From earliest records up until then, 90% of capital transactions had involved the “real economy”, ie trade and investment, with only 10% being speculation. By 1995 a staggering reversal had taken place – trade and investment accounted for only 5% of capital transfers, with 95% being short-term speculation.

Electronic trading networks have developed a virtual economy in which most of the money is made not through actual investment, but through transacting in a sort of abstract wealth. For example, huge profits have been made from rumours about indirect effects of future transactions – but the future transactions don’t necessarily have to happen for the profits to be made. Massive profits have been made from currency speculation, conjured up by supercomputers which transact fast enough to exploit microfluctuations in exchange rates.

Very little of this virtual-economy profiteering produces anything of value in the sense of “real wealth” – ie things of real value to human lives. Short-term financial speculation tends to create economies of high profit, low investment and low wages – in other words, it’s detrimental to the lives of most people. We have some strange notions about the respectability of certain types of income. When poor people receive modest welfare payments, they’re labelled “spongers”, but when speculators bleed vast sums from the digital economy, without producing anything of value, we congratulate them on their skill.

The Tobin Tax

James Tobin, a Nobel laureate economist, foresaw the detrimental effects of escalating currency speculation during the 1970s. He proposed a small tax on foreign currency transactions that would put “sand in the wheels” of international speculative finance, and thus help to prevent instability in the global financial system. It would also generate a vast amount of revenue.

This idea has resurfaced as an Internet phenomenon, the Robin Hood Tax.

Final thought to ponder (on Guaranteed Income)

“A system that is less expensive than welfare and also less debasing to the poor, it seems to me, should not be objectionable to anybody but hardcore sadists.”

— Robert Anton Wilson

* Quoted in Whoops! by John Lanchester. Johnson’s figures are for USA.

** Description of financial sector as “class of priests and magicians” is from Whoops! by John Lanchester

*** Much of the above article is adapted from a piece I had published in the Idler magazine, Winter 2002

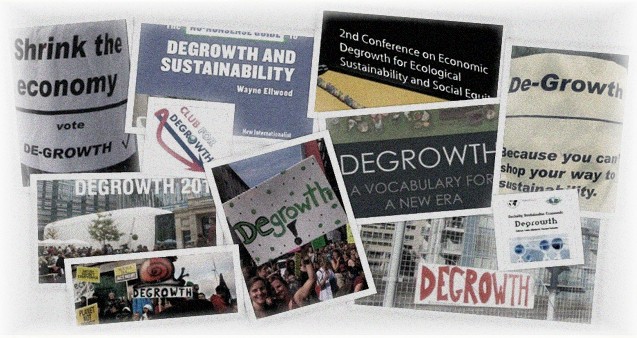

Both “growth” and “the economy” are what Lakoff calls ontological metaphors. They enable us to think about unthinkably multifarious phenomena (eg all the things “of value” that people do) in terms of “discrete entities or substances of a uniform kind”. This isn’t about “mere language”, but about how people think. The “price we pay” is to be stuck with crude, reductive (eg two-valued) logics, eg growth/no-growth. And it doesn’t help much to change the definition of “Gross Domestic Product” (GDP), or to divide “the economy” into sectors – it simply applies the same binary logic to slightly different, or smaller, entities.

Both “growth” and “the economy” are what Lakoff calls ontological metaphors. They enable us to think about unthinkably multifarious phenomena (eg all the things “of value” that people do) in terms of “discrete entities or substances of a uniform kind”. This isn’t about “mere language”, but about how people think. The “price we pay” is to be stuck with crude, reductive (eg two-valued) logics, eg growth/no-growth. And it doesn’t help much to change the definition of “Gross Domestic Product” (GDP), or to divide “the economy” into sectors – it simply applies the same binary logic to slightly different, or smaller, entities. Another aspect of market ideology reinforced by the “growth” frame is the heroic individualist entrepreneur fairy tale. “Growth” as a personal or individual-business metaphor seems unproblematic, but when we reflexively conceive of “the economy” as an object with an attribute of “growth”, the entrepreneur idea extends to it “naturally” because of the “good growth” frame. This is the myth that practically all wealth/”growth” derives from entrepreneurial enterprise, which is heroically fighting against “unnatural” interference to growth (eg from governments, “do-gooders”, Green activists, etc).

Another aspect of market ideology reinforced by the “growth” frame is the heroic individualist entrepreneur fairy tale. “Growth” as a personal or individual-business metaphor seems unproblematic, but when we reflexively conceive of “the economy” as an object with an attribute of “growth”, the entrepreneur idea extends to it “naturally” because of the “good growth” frame. This is the myth that practically all wealth/”growth” derives from entrepreneurial enterprise, which is heroically fighting against “unnatural” interference to growth (eg from governments, “do-gooders”, Green activists, etc).

This is the moral-metaphorical framing which has usurped the facts and figures. It doesn’t matter to the frame that the real costs of both

This is the moral-metaphorical framing which has usurped the facts and figures. It doesn’t matter to the frame that the real costs of both

This “orthodox” economics reflects Victorian (or earlier) frames and metaphors (eg see economist Paul Ormerod’s work in this regard*). And, going back to Charles Dickens, you can see the whole worldview described (and seemingly subtlely satirised) in his novel

This “orthodox” economics reflects Victorian (or earlier) frames and metaphors (eg see economist Paul Ormerod’s work in this regard*). And, going back to Charles Dickens, you can see the whole worldview described (and seemingly subtlely satirised) in his novel